Why choose us?

Expertise You Can Trust:

Backed by proprietary technology and a team of seasoned investment advisors with over 25 years of industry experience and 15 years dedicated to HOAs and Associations.

Fiduciary Investment Services:

Each Association is assigned a fiduciary-licensed investment advisor, ensuring your assets are managed with care and integrity.

Preferred Custodian:

Assets are securely custodied with our preferred providers -Charles Schwab Institutional and Fidelity Institutional, providing industry-leading safety, reliability, and peace of mind.

Innovative Technology:

HOA Invest Technology is a patent-pending solution designed to redefine how Associations handle their investments, streamlining processes and enabling informed decision-making.

15+

YEARS OF HOA EXPERTISE

25+

YEARS OF INVESTMENT ADVICE

1000+

SUCCESSFUL STRATEGIES

What we do?

Simplified HOA Investment Management

Compliance-Driven Investment Policies

- Designed to help meet unique state requirements.

- Provides controls, workflows, and documentation templates to help ensure compliance with your HOA or Association's investment policy.

- Collaborates with your HOA or Association to develop and implement an investment policy that aligns with regulatory guidelines.

Customized Investment Strategies

- Tailored strategies aligned with your HOA's goals, risk tolerance, and time horizon.

- Experienced advisors develop personalized solutions to meet your financial objectives while helping to adher to compliance requirements.

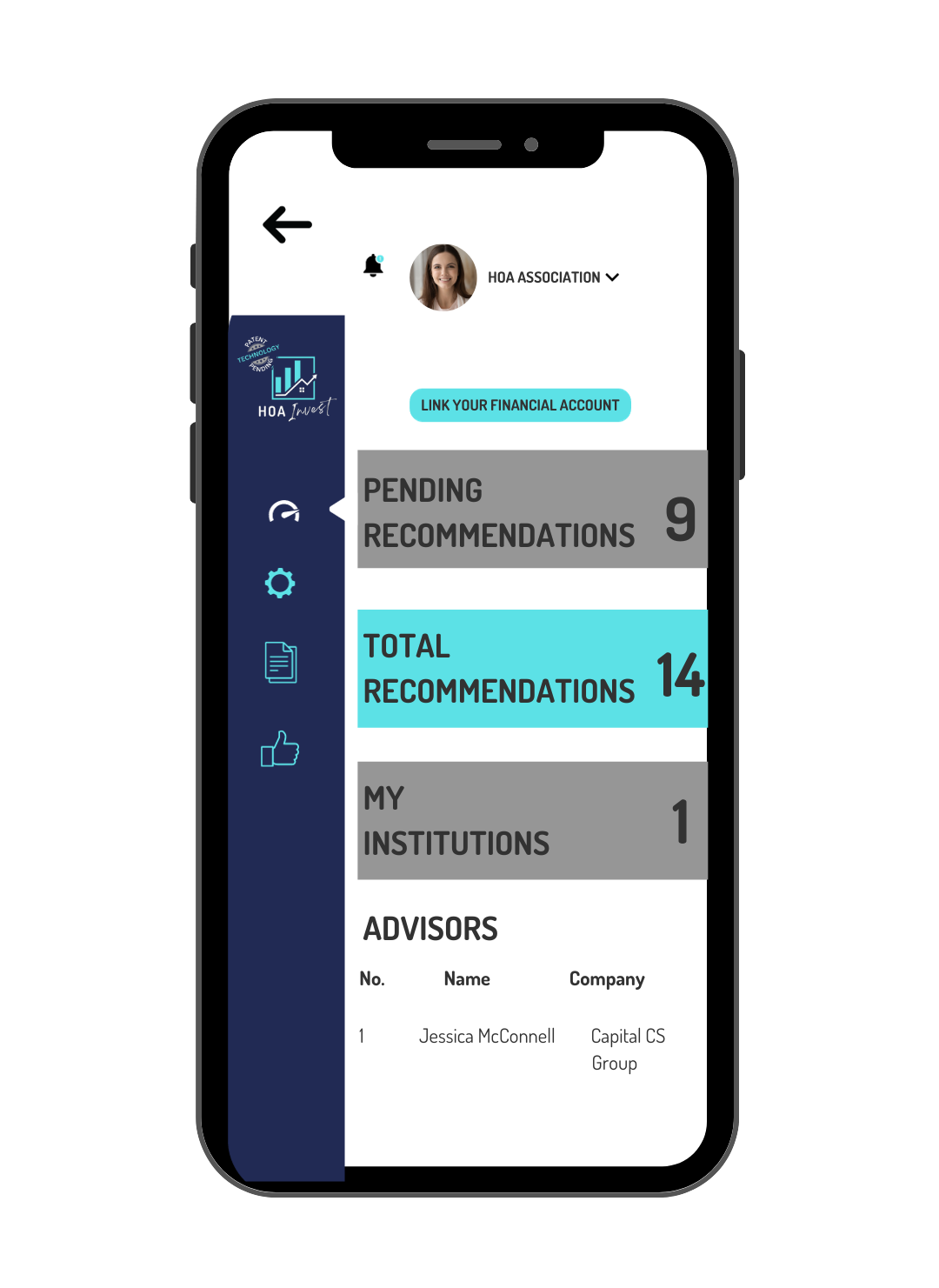

Efficient Investment Monitoring

- Provides daily tracking of investment holdings and maturing assets.

- Sends investment recommendations to managers and boards 90 days prior to maturity to ensure timely instructions, avoiding idle cash.

- Receive Daily Updates: Access financial data through the HOA Invest application, API integrations, daily data delivery, or downloadable CSV files.

- Alerts for potential violations allow proactive decision-making based on accurate data.

Start Your Journey with HOA Invest Today

To get started with HOA Invest, simply click "Sign Up" and enter your Association's details. An experienced investment advisor from HOA Invest will then reach out to guide you on your investment journey.

Exclusively offered through

Capital CS Group

15375 Barranca Parkway

Suite G-110

Irvine, CA 92618

Keystone Private Wealth

73575 El Paseo

Suite C-2300

Palm Desert, CA 92260